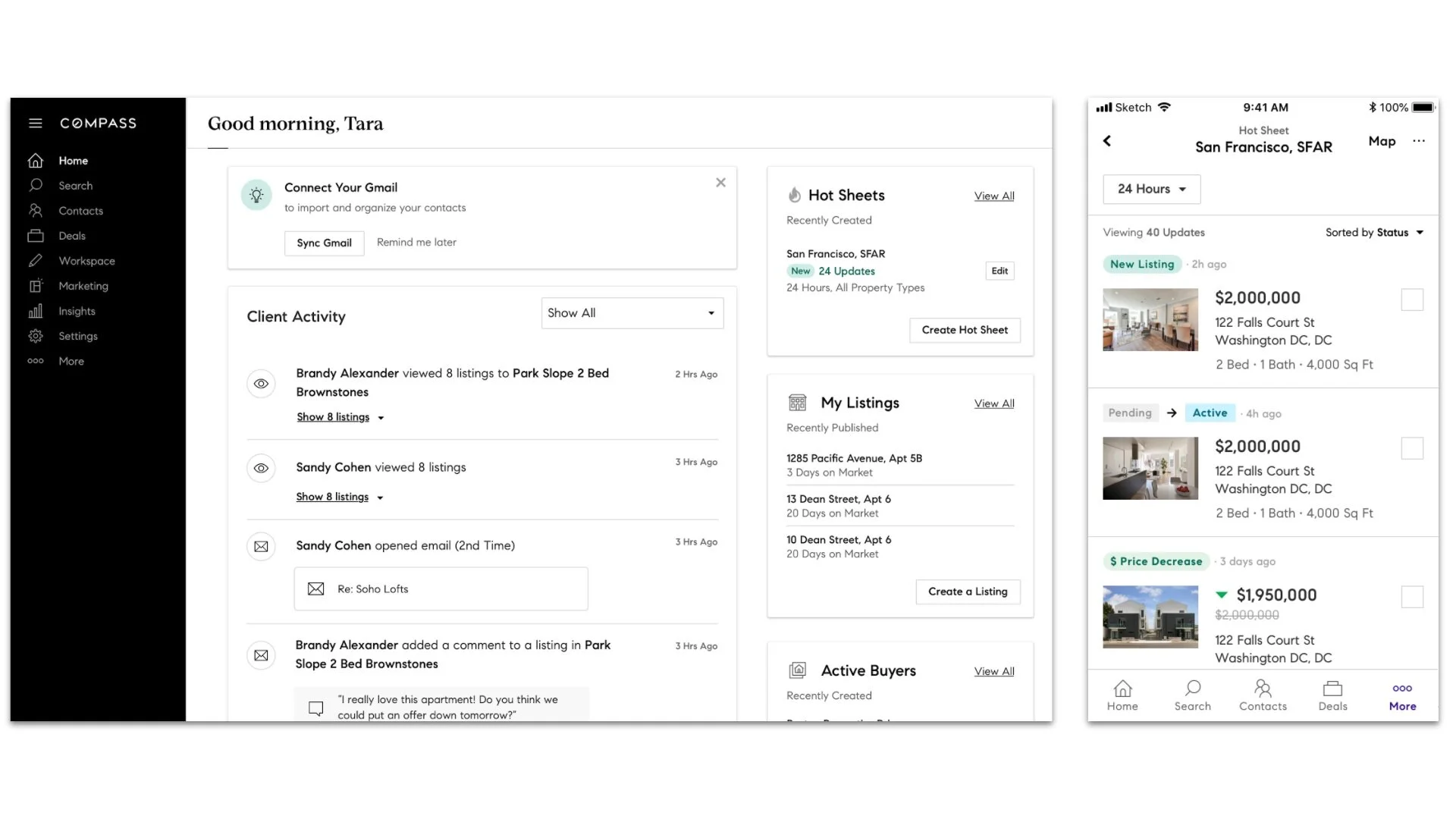

compass “hot Sheet”

As more tools become available for buyers to search for homes and apartments on their own, it is crucial for agents to be aware of all market changes as soon as they occur to prove their value in market knowledge and obtain / retain clients. In 2019 a major request from Compass agents, via an internal feedback channel, was for the MLS “Hot Sheet” feature to be included in the Compass platform.

Compass hot sheet web and mobile

Challenge & Goals

In an effort to help agents obtain and retain more clients by increasing their value as an information source, the team sought to build a feature within the Compass platform that would deliver market change information as close to as real-time as possible.

Timeline

This project spanned 6 months from kick off to release. Research included initial desk research (1 week), primary research (2 weeks), two rounds of concept testing (2 weeks) and two rounds of usability testing (2 weeks).

Roles & contributors

The core team consisted of a Product Manager, Product Designer, Product Marketing Manager and Engineering Director. Together we developed the product vision and goals and aligned on what we knew / did not know to inform the research strategy. Core team members attended research sessions (the Director of Engineering included selected engineers throughout). I personally designed the research strategy and executed all aspects of research.

research Questions

The team set out to provide agents with a “hot sheet”esque product within the Compass platform; however it was important to first understand the need and current behaviors of agents in order to ensure the we were providing the appropriate solution. High level research questions included:

What is the severity of this feature gap; what is the perceived consequence of it’s absence?

Does this problem / need impact multiple agent segments (i.e. region, tenure, team-size)?

What does “staying up to date with the market'“ mean to agents; what specific information is relevant to this process; how do agents do this today with (with and without an MLS “hot sheet”)?

SECONDARY RESEARCH

To obtain directional insight and align on project goals and strategy, I conducted an audit of our internal feedback channel (Canny), an audit of existing relevant research (topics on agent routines, market data, and real estate agent tooling) and an exploratory analysis of existing user data.

Hot Sheet in MLS, SFAR

When exploring our internal feedback channel (Canny), I investigated how many requests for hot sheet functionality were coming from MLS markets (knowing that some MLS systems had a hot sheet feature themselves) in order to determine if this request was feature parity related. Additionally, I sought to determine any direction of why this functionality was needed.

From prior research I looked to see if this behavior (searching for market updates) was part of an agents “day to day” and discern any patterns around when this behavior would occur, what (if anything) would trigger the behavior and any patterns around who executed on this (i.e. did less tenured agents do this more often?).

And lastly, in finding anecdotal evidence that agents were using an existing feature, Saved Search, in order to check market updates, I leveraged our internal user data on Saved Searches to better understand how this feature might be already leveraged by agents to satisfy this need - and where, if it all, it fell short compared to the requests.

PRIMARY RESEARCH

Secondary research helped us see that there was a true user need inside and outside of MLS markets. However, given the existing knowledge gaps around how and why agents stay up to date with market insights and additional questions generated from secondary research, it was necessary to speak with agents directly to better understand:

What does “staying up to date with the market” even mean?

How do agents (within and outside MLS markets) service this need today (with Compass Saved Search; on their own)?

What market information is important in order to provide value to real estate businesses?

Because these questions warranted a deep dive into the varying minds and processes of real estate agents, I conducted 1:1 in-depth-interviews with agents ranging in tenure (to better understand how/if behaviors were influenced by experience in the field) and market (to determine regional needs and understand any differences between MLS and non-MLS markets). This allowed me to explore fuzzy concepts (“staying up to date”), probe deeper into responses, and observe real time processes and tool use while asking follow-up questions and clarifications.

These were 45-minute remote moderated sessions. In each session, participants described what “staying up to date” meant to them when it came to their particular real estate practice so that we could understand any patterns around how agents interpret market information and identify what market information was critical in the process. Participants were also asked to share any tools or resources being used currently in their practice.

Insights from these sessions helped paint a picture of the importance of accurate and fast market data for real estate businesses. It also demonstrated what information agents, across multiple markets and tenure, found critical for staying up to date and being a credible source of knowledge for their clients.

Some insights included (*this is a sample not full list):

Agents who use a hot sheet or equivalent tool are reviewing it on a daily basis at minimum (demonstrating the importance of this process/information and the frequency at which information must be provided)

Agents need to be able to consume a lot of information quickly because speed of information impacts their business (informing the direction of layout and density of information in a product/feature).

Inaccuracies and delays in market information have negative impacts to an agent’s business (highlighting the risks of this product/feature).

Prototype testing

Based on user insights, the team decided that the need and opportunity for a hot sheet feature was worth investing in. Additionally, based on the learnings that agents frequently checked for updated market data and the existing knowledge that agents are often on-the-go (showing or touring homes), the team decided to pursue a mobile experience first.

Early mobile designs

Two rounds of concept testing were executed alongside iterative design. In the first iteration, we tested a novel representation of “hot sheet” that did not follow the MLS or industry standard of hot sheets; however, findings from this iteration showed that this version was confusing and was not a good user experience. The second concept, which was closer to existing hot sheet functionality of MLS, proved to be more understandable and usable by both agents who have used MLS hot sheets and agents who had never used an MLS hot sheet feature.

In both rounds of testing, 6-7 agents were recruited with a range of product familiarity/use (of Compass Saved Search feature and MLS hot sheet feature) and markets.

Once the concept direction was solidified and insights were gathered from concept testing, I conducted usability testing to assess ease of use and understandability of minor designs tweaks from concept testing. This testing was conducted in-person to ensure mobile usability with 7 real estate agents who were asked to execute a series of tasks within the prototype (create/save a hot sheet, provide me with information about their market, and edit a saved hot sheet).

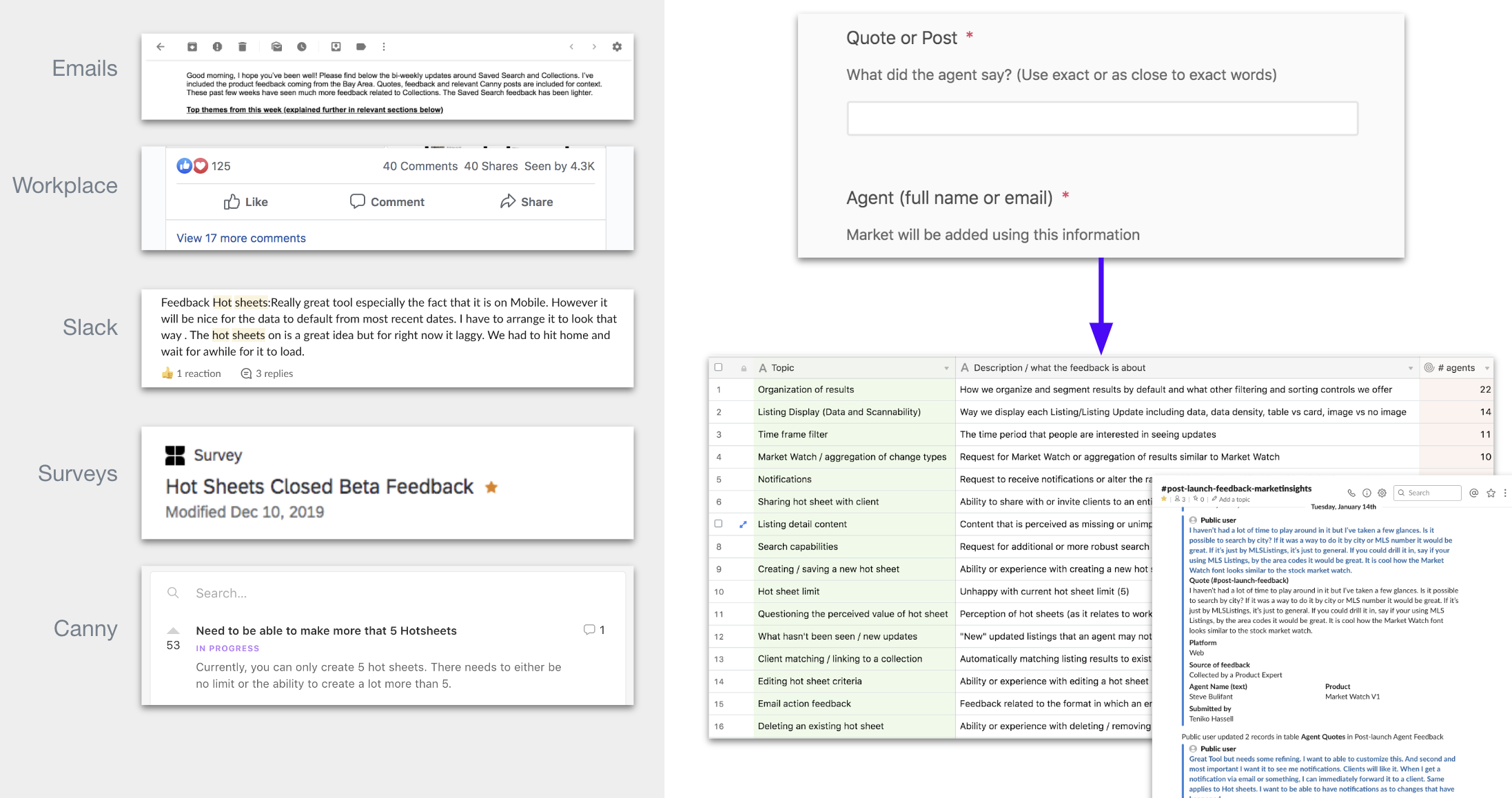

release and feedback

The hot sheet feature was released in alpha and beta groups with feedback surveys implemented to collect insights on the early access users; however at the time there were several additional channels from which feedback was being provided (including via email, in Compass workplace, slack, and our internal feedback tool Canny) in addition to formatted surveys. In order to collect this rich feedback, I implemented a feedback process that leveraged Airtable and allowed cross-functional team member to consolidate feedback from varying channels into one place. I then synthesized this information alongside survey data and provided the team with a cohesive representation of user feedback.

After observing low activity and adoption in non-MLS markets and directional insights via lightweight survey, the feature was rebranded “Market Watch” and activity drastically increased.

Emerging behaviors with the tool in addition to overlapping functionality with other Compass products continue to inform future improvements and roadmap.